Deposit Receipts have a long history of helping businesses make secured transactions. It is the most important document issued to the depositor as proof of payment. More and more businesses are generating online Deposit Receipts to save time, effort, and resources.

What is a Deposit Receipt?

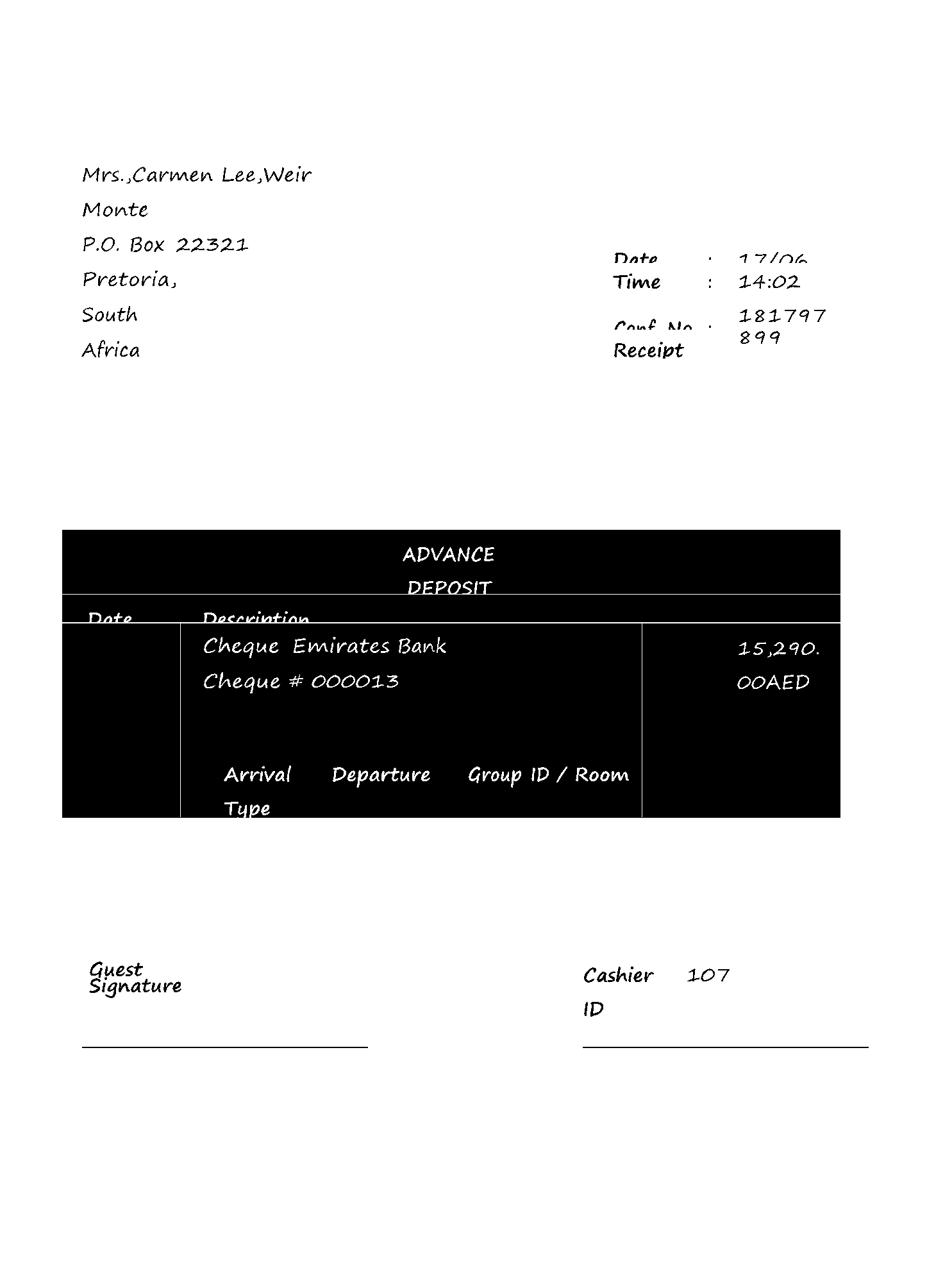

A deposit receipt is a document acknowledging that an amount has been received by the institute. This document is given to the payer who has deposited the money as proof. If the deposited money does not reflect in a bank account or any other account, the customer can use this receipt as a reference to get a proper solution.

A deposit receipt can be issued for a one-time payment or it can be used for recurring payments. Sometimes, money lending institutes use deposit receipts to show the received amount while mentioning the remaining amount to be paid by the other party. That is why you can use a deposit receipt for different purposes.

What are Types of Deposit Receipts?

There are different types of Deposit receipts that you can generate. Usually, it depends on the type of business you are running as each business has unique requirements.

However, here are the most popular deposit receipts that you can generate with a deposit form template.

Financial Institution Deposit: When a person deposits an amount of money in a financial institution like a Bank or Money lender, they receive a money deposit receipt. It is the most common deposit receipt you will ever come across.

Car Deposit Receipt (DownPayment or EMI): Car loan repayments require the owner to pay some monthly installments. After paying the required amount, they are issued car deposit receipts in their name as payment proof.

Security Deposit: A tenant living on a rented property gets a security deposit receipt after paying the agreed price to the owner.

How to Write a Deposit Receipt?

A deposit receipt can be prepared with the use of a template. You can find the template at the top of this page. Click on the Get Form button to access the template. After that, you can start editing it directly to enter all the details.

Here are the sections that you must fill to complete this agreement.

Section1- Depositor’s Information

The first section includes the depositor’s information along with their contact details. It is important as the amount is to be credited according to that information.

Section2- Amount and Purpose

Here, the depositor needs to fill the amount that he/she is planning to deposit. Additionally, they need to list out the purpose for which they are depositing that amount.

Section3- Acknowledgement

In this section, the person needs to acknowledge the deposit by mentioning the amount. Also, it requires the signature of the depositor and the verifying agent of the institution.

Conclusion

The main aim of generating a Deposit Receipt is to have payment proof. Therefore, every business must issue a deposit receipt every time a customer makes some kind of deposit.