Very often, people and businesses provide donations and gifts to others as a gesture of goodwill. As an added benefit, the IRS has provisions that provide tax deductions to people for their donated amount.

For this purpose, a donation receipt is required. You can create a donation receipt yourself with a free donation receipt template available for download online.

Keep reading to learn more about donation receipt templates and the requirement to use a donation receipt.

What Information A Donation Receipt Should Contain?

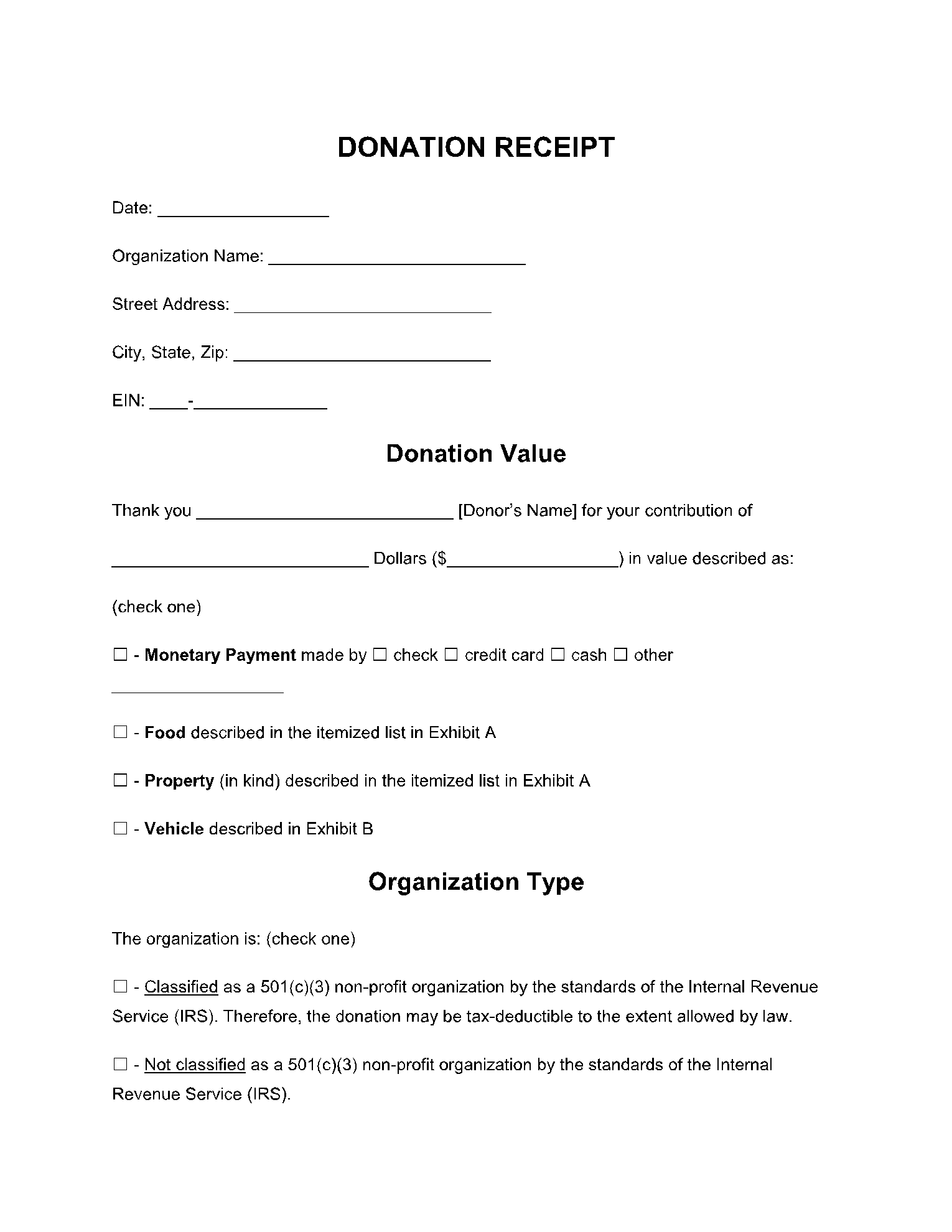

A donation receipt contains information such as:

Date

The date of donation is quite essential. The date should fall in the year for which the individual is seeking tax deductions.

Donee I

Donee and Donor Information

Provide the name of the organization to which the donation is made (Donee). You also need to provide their EIN of the charity. For the donor, mention their name and mailing address.

Donation Value

In the case of cash donations, the donation value can be mentioned as it is. In the case of the donation of personal property like clothes and appliances, the donation value is based on the property’s monetary value.

For claiming contributions less than $500, the appraisal can be done by the donor. For claiming donations of more than $500 but less than $5000, the donor has to get the items appraised by a professional appraiser. It should be completed within 60 days of the donation. For claiming donations of more than $5000, the donor has to fill the IRS Form 8283 Section B.

Donation Description

Mention the description of the donation made. In the case of cash, mention the amount paid as cash. In the case of goods, mention the quantity and description of each item that is donated.

Declaration

In order to be eligible for tax claims on donations, the IRS requires that the donor receives no goods and services from the donee in return. The donation receipt should contain a declaration of the same, signed by the donor.

How Do I Write A Donation Receipt?

Follow the steps below to create a donation receipt:

Step 1: Download the donation receipt template

Download the free template in Doc or PDF format. These templates have a standard structure, so generally, any modification in the template itself isn’t required.

Step 2: Fill in the details

Provide the details required in the donation receipt. Fields such as EIN and the official name of the organization can be obtained by making a phone call to the charity.

Step 3: Verification

The donation receipt requires the signature of the organization representative that is receiving the donation. The name and title of the representative are also required.

Donation Receipts Best Practices

When it comes to donation receipts, the following practices should be followed:

- The amount of tax deductions claimed through a donation receipt cannot exceed 50% of the gross total income in any case.

- The copy of the donation receipt should be kept for at least three years after making the donation or two years after filing the taxes for that year, whichever is later.

- Check online for what items are hazardous and should not be donated. Not all items are tax-deductible for donations, so check online for the list of the same.

- When appraising the items for claims less than $500, do not exaggerate the monetary value as this can be seen as a fraud in a tax audit.

Endnotes

There are many people who are unaware that donations to a charity are tax deductible. With a donation receipt, one can easily claim a lot of deductions in the taxes. You don’t need to visit any organization to obtain the receipt template, as it can be downloaded here for free.

Fill this donation receipt template right after making a donation. Always refer to these while filing the taxes, to accurately calculate the deduction you are eligible for.