The concept of renting out a house or apartment has become an increasing norm. Similarly, so is our understanding of the related documents. Along with many documents, keeping a track record of rent payment is very important as it will help you sort out the payment as well as tenants' details.

This record-keeping is possible by using the rent receipt. Just like a receipt from the store, a rent receipt is documentation of rent paid by a tenant to a landlord.

What Is a Rent Receipt?

A rent receipt template is an essential tool to document the rent payment deposited by the tenant to their respective landlord. A landlord or property management may use the receipt to keep track of all rent payments made by occupants of any rented property. The rent payments can be in the form of cash, cheques, or even money order.

After receiving the rent, the landlord is obligated to keep a record and provide the rent receipt to the tenant. Rent Receipt can help both parties of landowner and renters.

- For a landlord, it assists them with keeping track of incoming payments as well as any missed checks or late payments.

- For the tenants, this receipt assists in keeping proof of their rent payment within due time.

The Importance of Rent Receipts

The rental receipt has significance for a landlord and the tenant. It can help to clear many legal and tax issues. Following are some of the areas a rent receipt can help:

- Verifying the cash payments of the tenant. For cheques and money orders, there is a record. But for cash payments, the rent receipts are the only proof.

- The record of your rental history will have a positive impression on your prospective landlord. Keeping a record will help you demonstrate that you have a clear payment history and challenge any inconsistencies in your credit report.

- Rental tax credits are available in some states or offices. Rental receipts will help to prove your status as a renter, making it easier to obtain a tax refund or House Rent Allowance (HRA).

- In case of a dispute, your rental payment receipt having a copy of your rental receipts will help you work it out. It can also prevent complications like evictions or other charges etc.

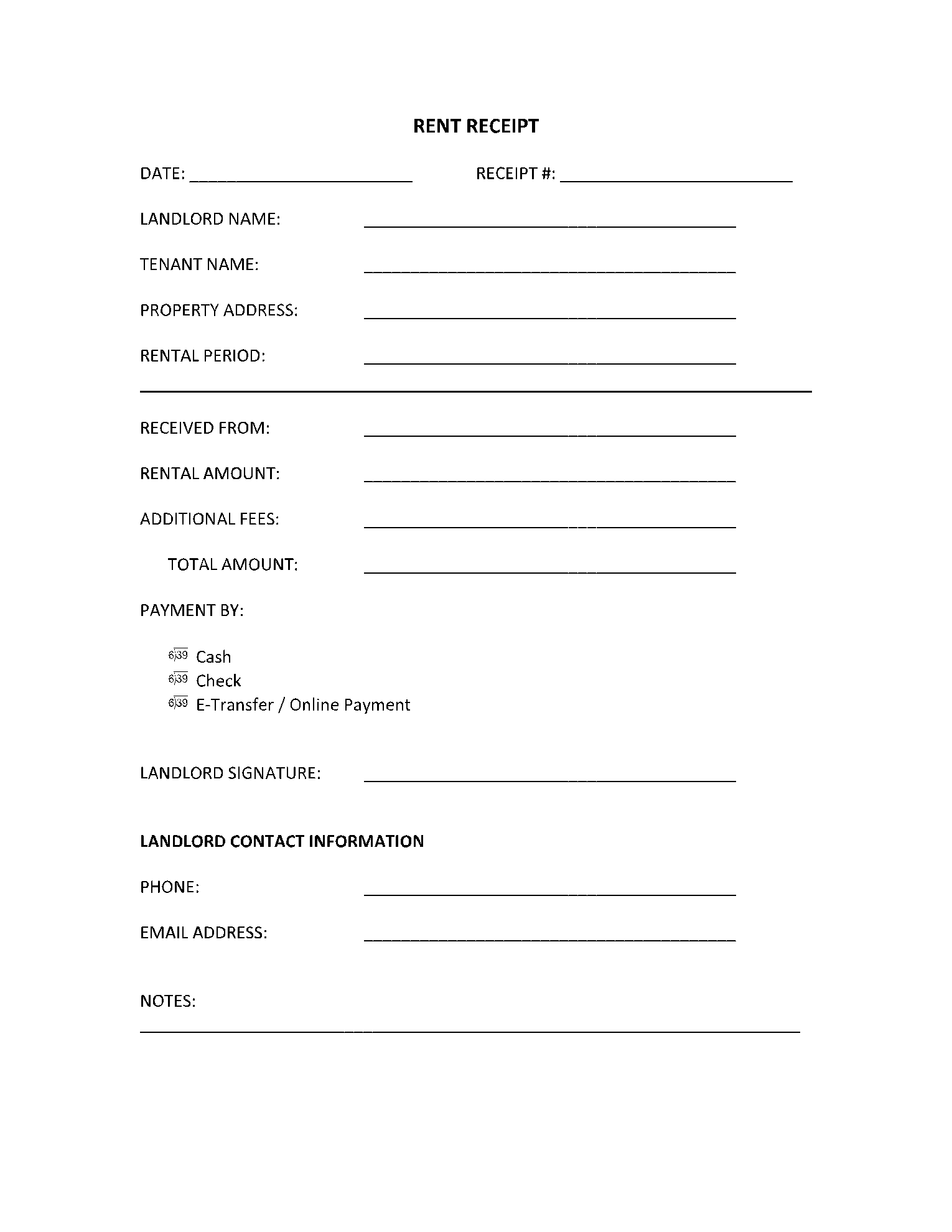

What Should Be Included in a Rent Receipt?

The more information you have on the rent receipt, the better it would be to keep track of everything. Although rental receipts can differ in detail, the following details must always be included:

- Receipt Number: The receipt number is written to differentiate and identify different copies of the rental slip.

- Name of the Tenant: The name of the renter who is responsible for paying the bill.

- Name of the Landlord: The name of the landlord to whom the tenant owes money.

- Contact Details: The contact numbers and complete address of the tenant.

- Amount of Rent Payment: Payment details of the occupant paid to the landlord must be included.

- Date of the Payment: The date on which the payment is given by the occupant.

- Payment Method: This section involves clarifying the method by which the payment was made. It can be cash, credit card, money order, or cashier's check.

- Rental Period: The time period in which the rent receipt is issued.

- Signature: Document completed by the signature or stamp of the landlord or rental manager.

For your financial or personal history, both landlord and occupants can maintain written or digital copies of the receipts.

Conclusion

One of the foremost tasks after renting a house or apartment should be to record the track of payments made by the tenant. Understanding and maintaining the rent receipt can prove to be very helpful. Different information on the receipt will not only help you maintain the record but also keep the rent or any legal disputes away.